Are the costs of professional staging tax deductible? This question comes up occasionally because some people would like to offset their capital gains after they sell their house.

There are some items that can and cannot be considered tax deductible when preparing your home for selling. Keep in mind no matter what your selling price is, the current real estate market demands a move-in ready home to entice buyers and increase the overall appeal of your home. Therefore the costs of staging a house are legitimate selling expenses for both primary and secondary homes. In order to be tax deductible, is that you must advertise the fact, either through your Real Estate Agent or by publically announcing that your home has been Professionally Staged.

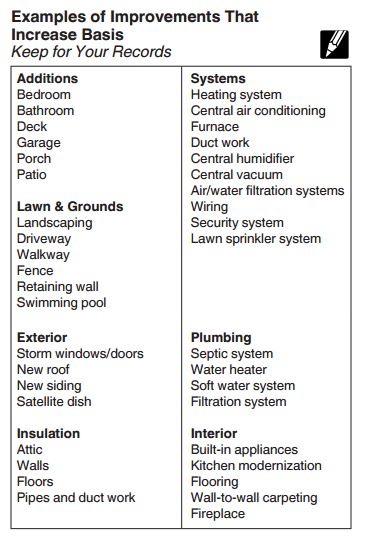

Additional costs that can are tax deductible are selling expenses such as commissions, advertising (which includes home staging) legal fees and loan charges or points. In addition, any improvements you have made to the property are also deductions according to the IRS publication 523.

Make sure that you have detailed records for any of the improvements that you may have made, these might be considered deductible also.

Professional Staging costs can be tax deductible provided that it is used for selling your home. Decluttering and organizing professional services in preparation for selling a house may also be tax deductible. If your home is vacant then the rental of furniture is also tax deductible while the house is for sale. If the furniture is rented and the client is still living in the house those rentals are not deductible.

Make sure to advertise that the property has been Professionally Staged. A staging consult is not considered tax deductible.

Remember to touch base with a CPA/Attorney to discuss your specific circumstances.